Jefferson Parish Sale Tax . The current total local sales tax rate in jefferson parish, la is 9.200%. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. 4.75% on the sale of general merchandise and certain services. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. This is the total of state, county, and city sales. Click for sales tax rates, jefferson parish sales tax calculator, and. the current sales tax rate in jefferson parish, la is 11.2%. the jefferson parish sales tax is 4.75%. jefferson parish, la sales tax rate. the following local sales tax rates apply in jefferson parish: the minimum combined 2024 sales tax rate for jefferson parish, louisiana is 9.2%.

from www.formsbank.com

the current sales tax rate in jefferson parish, la is 11.2%. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. the minimum combined 2024 sales tax rate for jefferson parish, louisiana is 9.2%. the following local sales tax rates apply in jefferson parish: This is the total of state, county, and city sales. the jefferson parish sales tax is 4.75%. Click for sales tax rates, jefferson parish sales tax calculator, and. jefferson parish, la sales tax rate. 4.75% on the sale of general merchandise and certain services. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on.

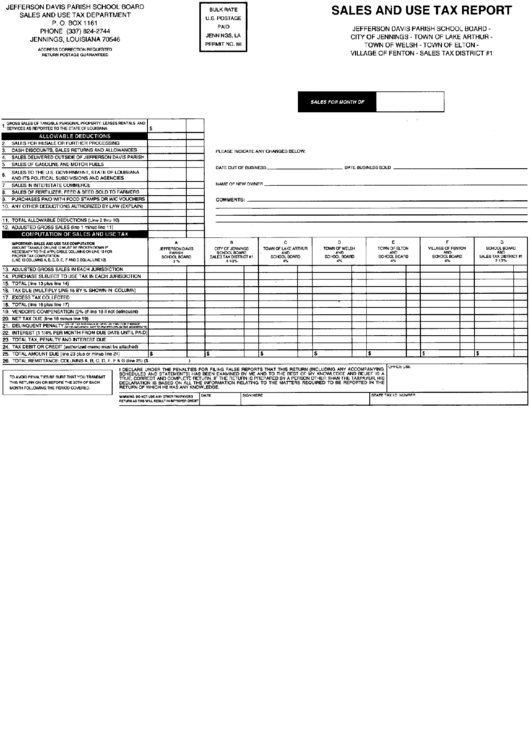

Sales And Use Tax Report Form Jefferson Davis Parish School Board

Jefferson Parish Sale Tax the following local sales tax rates apply in jefferson parish: the current sales tax rate in jefferson parish, la is 11.2%. Click for sales tax rates, jefferson parish sales tax calculator, and. the following local sales tax rates apply in jefferson parish: in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. jefferson parish, la sales tax rate. The current total local sales tax rate in jefferson parish, la is 9.200%. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. 4.75% on the sale of general merchandise and certain services. This is the total of state, county, and city sales. the minimum combined 2024 sales tax rate for jefferson parish, louisiana is 9.2%. the jefferson parish sales tax is 4.75%.

From www.formsbank.com

Occupancy Tax East Bank Jefferson Parish printable pdf download Jefferson Parish Sale Tax the jefferson parish sales tax is 4.75%. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. jefferson parish, la sales tax rate. the current sales tax rate in jefferson parish, la is 11.2%. Click for sales tax rates, jefferson parish sales tax calculator,. Jefferson Parish Sale Tax.

From kambing145.blogspot.com

jefferson parish property tax assessment Pattie Calhoun Jefferson Parish Sale Tax The current total local sales tax rate in jefferson parish, la is 9.200%. the following local sales tax rates apply in jefferson parish: Click for sales tax rates, jefferson parish sales tax calculator, and. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. the. Jefferson Parish Sale Tax.

From jolandalaflamme.blogspot.com

jefferson parish property tax due date Jolanda Laflamme Jefferson Parish Sale Tax the following local sales tax rates apply in jefferson parish: the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. the current sales tax rate in jefferson parish, la is 11.2%. the jefferson parish sales tax is 4.75%. jefferson parish, la sales tax rate. The current total local. Jefferson Parish Sale Tax.

From www.formsbank.com

Form 0001 R Sales Tax Form Bureau Of Revenue And Taxation Grenta Jefferson Parish Sale Tax The current total local sales tax rate in jefferson parish, la is 9.200%. the current sales tax rate in jefferson parish, la is 11.2%. the minimum combined 2024 sales tax rate for jefferson parish, louisiana is 9.2%. 4.75% on the sale of general merchandise and certain services. This is the total of state, county, and city sales. . Jefferson Parish Sale Tax.

From www.formsbank.com

Sales And Use Tax Report Form Jefferson Davis Parish School Board Jefferson Parish Sale Tax the jefferson parish sales tax is 4.75%. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. the current sales tax rate in jefferson parish, la is 11.2%. Click for sales tax rates, jefferson parish sales tax calculator, and. the sales/license tax division collects. Jefferson Parish Sale Tax.

From www.wdsu.com

Jefferson Parish leaders 'extremely concerned' about government’s Jefferson Parish Sale Tax The current total local sales tax rate in jefferson parish, la is 9.200%. jefferson parish, la sales tax rate. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. the jefferson parish sales tax is 4.75%. the sales/license tax division collects local sales and. Jefferson Parish Sale Tax.

From changecolorofyourtrac31812.blogspot.com

Our Larger Diary Picture Galleries Jefferson Parish Sale Tax 4.75% on the sale of general merchandise and certain services. the following local sales tax rates apply in jefferson parish: jefferson parish, la sales tax rate. the current sales tax rate in jefferson parish, la is 11.2%. Click for sales tax rates, jefferson parish sales tax calculator, and. in addition to the sales/use tax imposed on. Jefferson Parish Sale Tax.

From www.formsbank.com

Occupancy Tax West Bank Jefferson Parish printable pdf download Jefferson Parish Sale Tax 4.75% on the sale of general merchandise and certain services. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. the current sales tax rate in jefferson parish, la is 11.2%. This is the total of state, county, and city sales. the following local sales. Jefferson Parish Sale Tax.

From www.formsbank.com

Application For Refund Of Taxes Paid City Of Jefferson Parish Jefferson Parish Sale Tax the following local sales tax rates apply in jefferson parish: the jefferson parish sales tax is 4.75%. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. Click for sales tax rates, jefferson parish sales tax calculator, and. the minimum combined 2024 sales tax. Jefferson Parish Sale Tax.

From www.formsbank.com

Sales And Use Tax Report Jefferson Davis Parish Louisiana Jefferson Parish Sale Tax jefferson parish, la sales tax rate. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. the current sales tax rate in jefferson parish, la is 11.2%. Click for sales tax rates, jefferson parish sales tax calculator, and. the following local sales tax rates apply in jefferson parish: 4.75%. Jefferson Parish Sale Tax.

From www.formsbank.com

Sales And Use Tax Return Form Parish Of East Carrol printable pdf Jefferson Parish Sale Tax The current total local sales tax rate in jefferson parish, la is 9.200%. 4.75% on the sale of general merchandise and certain services. Click for sales tax rates, jefferson parish sales tax calculator, and. jefferson parish, la sales tax rate. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. . Jefferson Parish Sale Tax.

From www.theadvocate.com

Jefferson Parish to use future sales tax revenue for improvements Jefferson Parish Sale Tax the minimum combined 2024 sales tax rate for jefferson parish, louisiana is 9.2%. This is the total of state, county, and city sales. jefferson parish, la sales tax rate. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. 4.75% on the sale of general merchandise and certain services. . Jefferson Parish Sale Tax.

From www.formsbank.com

Tax Form Jefferson Parish printable pdf download Jefferson Parish Sale Tax Click for sales tax rates, jefferson parish sales tax calculator, and. This is the total of state, county, and city sales. 4.75% on the sale of general merchandise and certain services. the current sales tax rate in jefferson parish, la is 11.2%. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales. Jefferson Parish Sale Tax.

From www.formsbank.com

Jefferson Parish Occupancy Tax Form (West Bank) printable pdf download Jefferson Parish Sale Tax the following local sales tax rates apply in jefferson parish: the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. the current sales tax rate in jefferson parish, la is 11.2%. jefferson parish, la sales tax rate. in addition to the sales/use tax imposed on transactions occurring in. Jefferson Parish Sale Tax.

From nolamoviecars.com

NOLA Film Automotive NOLA Movie Cars Picture Car Rentals in New Jefferson Parish Sale Tax the current sales tax rate in jefferson parish, la is 11.2%. jefferson parish, la sales tax rate. in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional sales tax of 2% is imposed on. the jefferson parish sales tax is 4.75%. the minimum combined 2024 sales tax rate for jefferson. Jefferson Parish Sale Tax.

From learningschoolhappybrafd.z4.web.core.windows.net

Sales Tax Exemption Form For Arkansas Pdf Jefferson Parish Sale Tax the current sales tax rate in jefferson parish, la is 11.2%. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. Click for sales tax rates, jefferson parish sales tax calculator, and. The current total local sales tax rate in jefferson parish, la is 9.200%. 4.75% on the sale of general. Jefferson Parish Sale Tax.

From www.svngilmoreauction.com

Jefferson Parish Adjudicated Property Auction Jefferson Parish Sale Tax the jefferson parish sales tax is 4.75%. jefferson parish, la sales tax rate. This is the total of state, county, and city sales. Click for sales tax rates, jefferson parish sales tax calculator, and. the current sales tax rate in jefferson parish, la is 11.2%. the following local sales tax rates apply in jefferson parish: The. Jefferson Parish Sale Tax.

From www.formsbank.com

Sales And Use Tax Return Instructions Jefferson Parish printable pdf Jefferson Parish Sale Tax the minimum combined 2024 sales tax rate for jefferson parish, louisiana is 9.2%. the jefferson parish sales tax is 4.75%. jefferson parish, la sales tax rate. The current total local sales tax rate in jefferson parish, la is 9.200%. 4.75% on the sale of general merchandise and certain services. This is the total of state, county, and. Jefferson Parish Sale Tax.